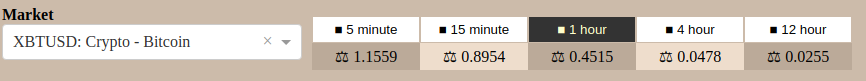

Select a market to trade from the drop down and a quote duration by clicking on the appropriate duration you are looking for:

In this case the trader has chosen XBT/USD as the currency exchange rate to trade, and 1 hour for the quote duration. The time the trade is created, plus the quote duration is what sets the trade's expiration time (i.e. the time from trade initiation to settlement is the quote duration).

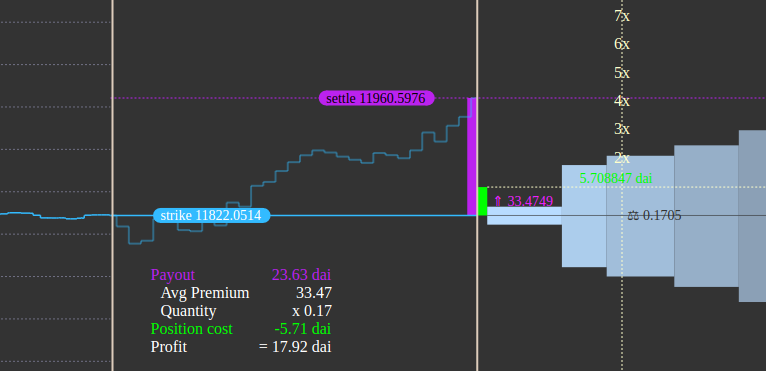

To go long (buy a call), hover the mouse on the right hand side of the screen so that a green bar (and not a red bar) appears to the right of the chart as shown below:

In the example above, the horizontal tan dotted line at the top of the green rectangle represents the break-even point of the trade. For every multiple of that amount the price rises over the next hour, the trader will make that amount back on the trade. In the example, the trader pays 5.6 DAI to place the trade. If the price moves up to where the purple "settle" line is placed in the outcome visualizer in the next hour, the trader will make 4 x 5.6 = 22.4 DAI.

Note that the larger the quantity you buy (by moving the vertical dotted line further to the right), the premium becomes more expensive, increasing the amount the price has to move to 2x, 3x or 4x your trade. Keep this in mind when selecting a premium.

As you move the mouse left and right, you adjust the quantity of the trade, and under some market conditions the break even point will not be the same height as your cost, for example if there are multiple quotes available to trade for that time duration.

Trading a put is done the same way, except now there is a red bar instead of the green bar that shows the amount XBT/USD will have to drop in order for this trade to make a profit.

Once you have chosen the approximate quantity and cost you want, click the mouse and a dialog will pop up allowing you to fine tune the quantity and cost. You can then finish the trade, or cancel.

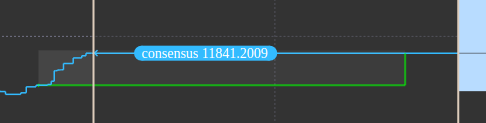

An example of a trade in progress is shown below:

Here the trade has almost reached the top of the gray rectangle, meaning the trade's value is equal to the original cost of the trade.

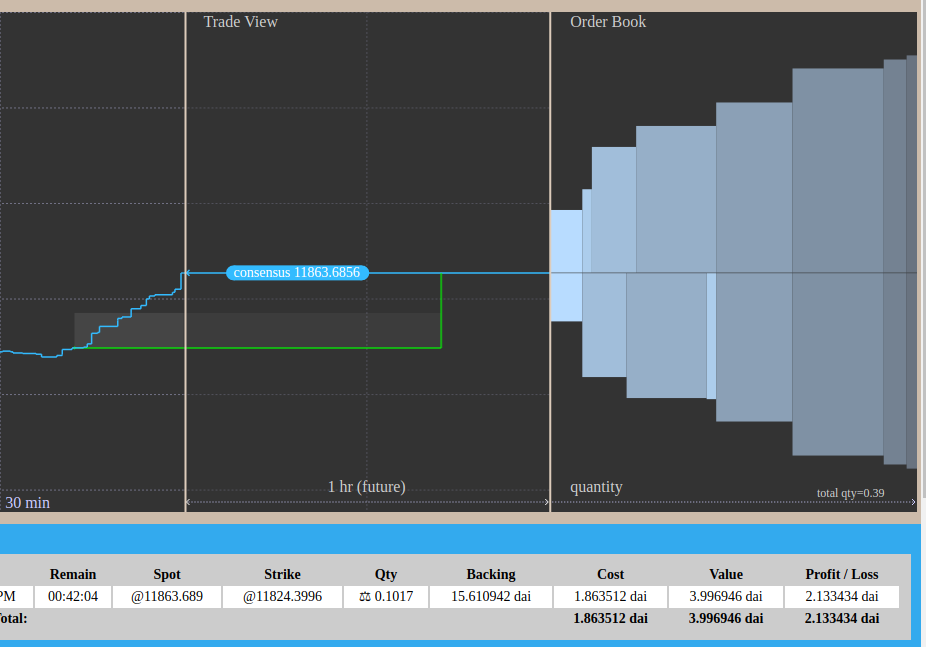

As the trade progresses (below), the price moves higher and here the trader has more than doubled his money on the trade:

Note that there is still a lot of time left -with the width of the rectangle representing the hour trade duration, only about 20 minutes has passed so a lot can still happen in terms of upward / downward price movement.

Questions? Jump on the Microtick Telegram channel