Microtick offers a new mechanism for decentralized price discovery that decouples price discovery from trade order flow and can potentially solve the problems with price discovery mentioned previously. It can be used for any asset currently being traded, or even for assets that can’t be traded but can be conceptually identified such as groups of assets.

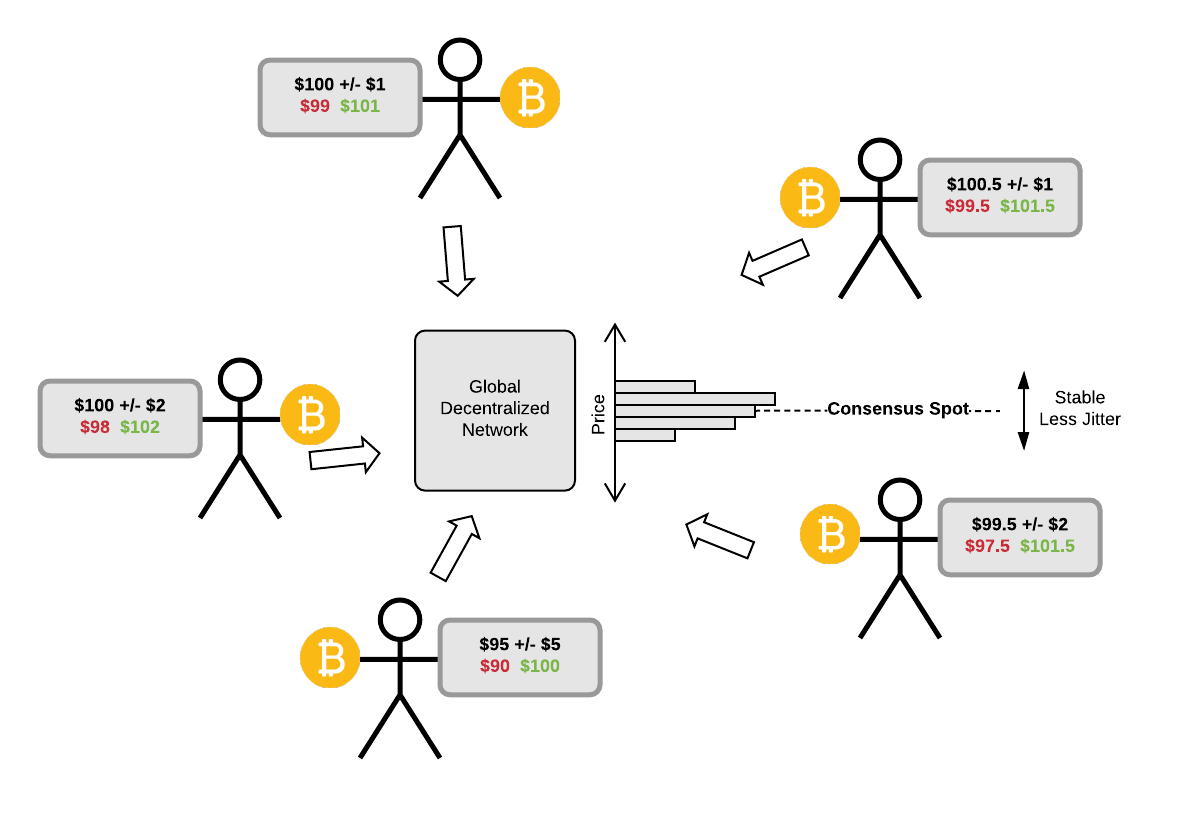

In the diagram below the actors are not taking long or short positions anymore. Instead, they submit a price assertion for an asset (in this case let's assume the asset is around $100 USD). With each assertion, the actors include an estimate for the price range (uncertainty) over a given time duration, such as +/- $1 USD for a 5-minute window of time.

The actors also provide an amount of token value attached to each price assertion, known as backing and indicated by the Bitcoin symbol in the figure. Backing does not have to be actual Bitcoin, any blockchain-based crypto asset would work as well.

For the top actor, the price estimate of $100 USD +/- $1 USD gives a range or $99 on the low side to $101 on the high side.

Notice that the price range gives an indication of confidence the actor has in the quoted price, with the tighter ranges generally indicating a higher confidence in the price estimate. The price range attached to an assertion is highly dependent on the time window chosen. Larger time windows will be associated with generally higher ranges because the volatility of the underlying asset has to be taken into account. Microtick standardizes time windows for quote markets: 5-minute, 15-minute, 1-hour, 4-hour and 12-hour windows for trading.

In addition to tighter price ranges, generally higher amounts of token backing also indicate a higher degree of confidence in the quote as well. Microtick uses the ratio of backing / range to create an artificial "quantity" for quotes placed on the market. This quantity is used for trading as will be described later.

A "Consensus Spot" price is created by combining all the assertions placed on the network across all time durations into a single weighted average, with the spot price for each assertion weighted with the artificial quantity calculation described above.

The resulting system no longer has a spread between bids and asks as with legacy centralized price discovery. In addition, the system is more stable - with generally higher quantities of quotes towards the center of the range of estimates. The system is not tightly coupled to trading activity (although there is a correspondence we will discuss later). Finally, because we can account for block timing uncertainty as well as information propagation times in the premiums for the quotes, we can deploy the system on a global scale to arrive at a mutually agreed upon price estimate that is valid regardless of geographic location. (This works best in blockchain systems with fast finality such as Cosmos / Tendermint).