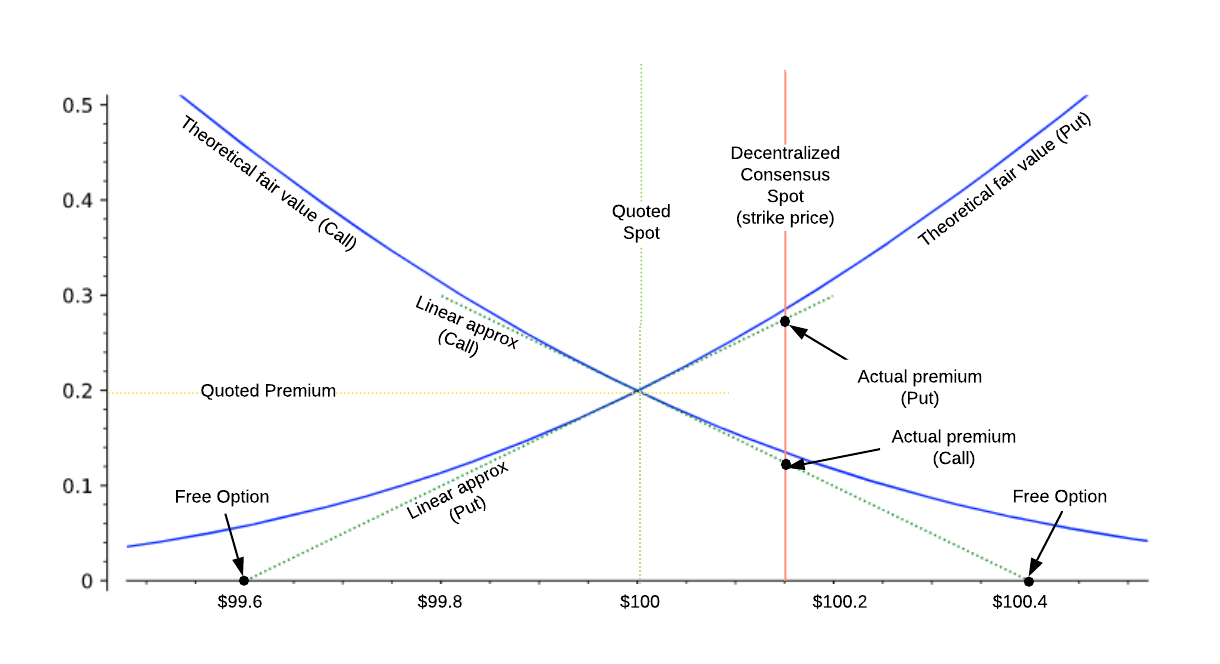

A price assertion placed by a market maker on Microtick is actually an bi-directional offer to sell either a call or put, with a strike price at the current consensus price and the time duration specified by the time window the quote was placed for. These time windows are for very short time windows (5 minutes, 15 minutes, 1 hour, etc). The buyer of the option (the trader) sets the direction by choosing whether the assertion will be traded as a call or a put. In the diagram below, notice that the fair value for an at-the-money call or put changes as the consensus price (the option's strike price) moves in relation to the quoted spot price.

As the consensus price moves away from a quote's spot price, Microtick automatically adjusts the ask premiums according to a linear approximation to theoretical fair value as shown in the diagram. Notice that the linear approximation is always slightly below theoretical fair value at all points except the point where it is at-the-money. This acts as an incentive for market makers to keep their quotes updated - if the consensus price moves far enough away from the quoted spot, there is a point where it becomes a free option - which represents a riskless trade for the option buyer.

In the diagram the quoted spot price of $100 lies below the current global consensus price of $100.15. Because the market maker originally quoted $0.20 for the option's premium, the price of a call with a strike at $100.15 is currently $0.12 and the price of a put is about $0.28. Think of it like this: if the trader agrees with the market maker that the consensus price is too high, the trader will buy the put and the market maker is rewarded and will receive slightly more than the ask premium. If the trader disagrees with the market maker and thinks the consensus price will be moving up, the market maker will be punished and receive only $0.12 instead of the original ask of $0.20.

The backing originally attached to the quote is now moved into the trade contract and is used to settle the trade after the time window has elapsed, for any price movement in favor of the buyer. After settlement, any remaining backing will be refunded to the market maker.